VGS Card Account Updater

Avoid Payment Disruptions with Updated Card Information

VGS Account Updater integrates directly with card networks to deliver the most up-to-date card-on-file information. Increase authorization rates and reduce failed transactions from lost, stolen, expired, or closed cards. Choose from account updates continuously on every card, in real-time on a selected set of cards, or a combination of the two.

Contact Us

Every year, 40% of cardholders replace their cards due to account closures, reported lost or stolen, expired, compromised by fraud, or upgraded.

When customers leverage account updating services, 20-35% of cards are updated in the first month.

Fewer outdated cards = fewer failed transactions.

48% of US consumers save their card information on merchant websites and apps to make credential/card-on-file (COF) payments. Storing information makes it easier for customers to shop online, set up recurring payments, and use demand-based services such as ride-sharing and grocery delivery apps.

However, 30% of shoppers will abandon their cart if they have to re-enter their payment information, and 59% of customers who have a negative customer experience are less likely to shop with that seller again.

Cart abandonment causes e-commerce brands to lose $18 billion in sales revenue annually.

Impact on you?

Lost sales. Impacted brand.

Fewer returning customers.

Merchant Solution

VGS Account Updater keeps your card-on-file data current and offers two customizable options to suit your needs. You can choose the update frequency and select specific cards for which to obtain the latest information.

- More frequent recurring billing like weekly or monthly subscriptions

- In-the-moment purchases requiring low latency like gaming, ride-sharing, e-commerce, and gig marketplaces.

Use it as a fail-safe to ensure you aren't sending expired cards to your processor and experiencing failed transactions.

Less frequent recurring billing like annual subscriptions when you can get account updates for near-term renewals in the month or weeks before renewal.

Immediate, high-value transactions, or initial subscription enrollment.

Merchant Benefits

VGS Account Updater keeps your card-on-file data current and offers two customizable options to suit your needs. You can choose the update frequency and select specific cards for which to obtain the latest information.

Combine with VGS Card Attributes and VGS Network Tokens

The best merchants in the business never lose connectivity to the full card number (PAN).

VGS Account Updater enables you to keep connectivity with the PAN. With a PAN, you retain the ability to retry the transaction with a processor, which you cannot do with just a token. Having a PAN also enables you to access VGS Card Attributes and run it on your cards-on-file at least every 6 months to ensure you have the most current credentials across expanding BIN ranges, shifting card portfolios, and changing issuers.

Combining VGS Account Updater with VGS Network Tokens can increase authorization rates and improve conversion by lowering payment declines. Use Account Updater for processors that don't accept network tokens or when you need the full card number for fraud prevention or identity protection.

Retaining connectivity to the PAN is critical to successful Card Lifecycle Management. Best-in-class merchants use VGS Account Updater, VGS Network Tokens, and VGS Card Attributes to have the most up-to-date card credentials and optimal payment outcomes.

VGS Account Updater Summary

Optimize Card-on-File Payments to Increase Revenue and Retention

VGS Account Updater automatically updates expired card information either continuously or in real-time to avoid payment declines and offer a seamless payment experience.

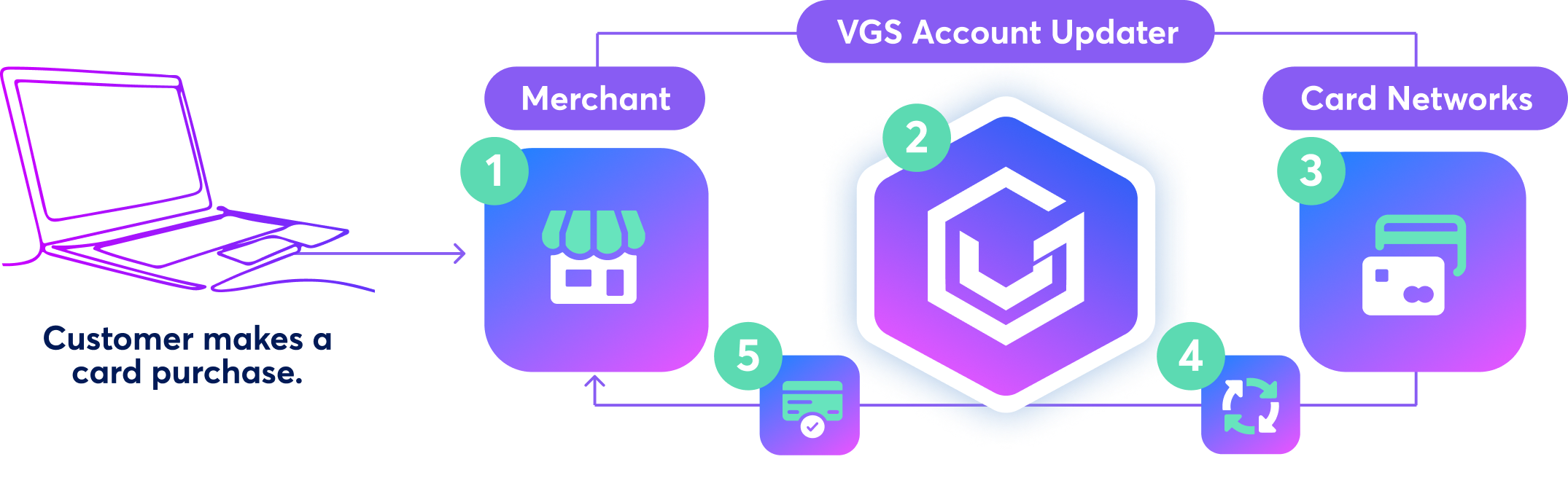

Merchant registers for VGS Account Updater

Merchant requests VGS for a card number (PAN) update.

VGS sends requests directly to the card networks for both types of account updates: Real-time and Continuous.

VGS receives card updates automatically from the networks and sends it back to the merchant. This includes:

- Sync (first-time immediate response) and

- Async (future updates after the card has been previously registered)

Merchant updates their Card-on-File (COF) information for a successful transaction.

Store and Enrich All Your Payment Data with a Single API Integration

Use a single card object across Network Tokens, Account Updater, and Card Attributes on our Card Management Platform.

Learn More about Card Management Platform

Ready to Get Started?

- Improve authorization rates with continuous and real-time card updates - avoid declined transactions becoming lost customers.

- Reduce or eliminate the form re-entry at checkout - prevent avoidable user experience issues from declined cards.

- Minimize required consumer intervention - manage those customers who forget to update card payment information.

- Reduce your costs with a processor-agnostic solution - Get a single solution across your processors and avoid lost sales from failed transactions.

Read More about the different ways to use VGS Account Updater.

Learn MoreWant to learn more about Account Updater?

Watch Payments 201, explains how Account Updater delivers the most up-to-date credential information to increase authorization rates, reduce failed transactions, and maximize operational efficiency.

Watch NowFAQs

An Account Updater integrates directly with card networks to deliver the most up-to-date card-on-file information. An Account Updater can continuously update multiple cards or in real-time on a selected card. Essentially, it keeps your card-on-file data up to date to increase authorization rates and reduce failed transactions.

- Enrollment: Businesses typically enroll in an account updater service through their payment processor or gateway.

- Data Submission: The business periodically (e.g., monthly or upon a failed transaction) sends a batch of its stored cardholder data to the account updater service. This usually includes card numbers and expiration dates.

- Matching and Verification: The Account Updater service compares this data against the card networks' (Visa, Mastercard, etc.) databases, which contain the most current card information provided by the issuing banks.

- Automatic Updates: If any of the submitted card details have changed, the Account Updater automatically updates the information and sends the updated details back to the business through their payment processor. Common updates include new expiration dates, new card numbers, or notifications that an account has been closed.

- Record Update: The payment processor then updates the business's records with the new card information, allowing for uninterrupted processing of future transactions. Some systems offer real-time updates.

VGS Account Updater supports major card networks, including:

- Visa (VAU)

- Mastercard (ABU)

- Discover

- American Express (EUA)

Support for additional networks can vary depending on your acquiring bank and region.

No. VGS utilizes data aliasing and tokenization to securely store sensitive information, ensuring PCI compliance. Real card data never touches your servers.

VGS performs regular updates (typically every 30 days or on demand, depending on configuration). It can also trigger updates when a transaction fails due to an outdated card.

Yes. VGS is PCI DSS Level 1 compliant. By using VGS, your organization minimizes PCI scope and risk while maintaining compliance.

- Reduces declined transactions: By keeping card details up to date, businesses can significantly decrease the number of failed payments due to expired or outdated cards.

- Improves customer experience: Customers don't have to manually update their payment information with every business with which they have recurring payments or stored cards with, leading to a smoother and more convenient experience.

- Increases revenue retention: Fewer declined payments mean less involuntary churn for subscription-based businesses and more successful repeat purchases.

- Reduces administrative burden: Automating the update process saves businesses significant time and resources that would otherwise be spent manually tracking and contacting customers for updated card details.

- Enhances data security: By relying on secure channels for updating card information, businesses reduce the risk associated with manually handling and storing sensitive cardholder data, potentially reducing their PCI DSS compliance scope.

- Helps prevent fraud: Promptly identifying closed or replaced cards can help businesses avoid fraudulent transactions on compromised accounts.

- Improves operational efficiency: Customer service and finance teams spend less time dealing with failed payments and chasing updated information.

You can contact VGS if you would like VGS's Account Updater. If you already have VGS solutions, please contact your account manager to activate the Account Updater feature.