Integrating 3DS while accepting payments can create user friction. Click To Pay offers an alternative to needing a separate 3DS integration.

When we discuss network tokens, a discussion on 3DS typically isn't far behind. Merchants rightly see network tokens as a way to mitigate fraud risks, and 3DS has been one of the long-established and required ways to achieve this. That said, both Visa and Mastercard have leaned into offering Click-to-Pay to take advantage of Network Tokens alongside 3DS.

3DS Background

So, why do merchants still adopt 3DS? Two reasons:

-

Liability Shift to Issuers

- When a cardholder's transaction is successfully authenticated using 3DS, the liability for fraud typically shifts from the merchant to the card issuer. This is a powerful financial incentive for merchants since the issuer would bear the financial responsibility for the excessive chargebacks or other types of fraud, not the merchant.

-

Compliance with Regulations

- For merchants operating in regions with stringent security regulations (PSD2), like Europe, 3DS helps ensure compliance with strong customer authentication (SCA) requirements.

3DS is an authentication protocol designed to reduce fraud and increase consumer confidence in e-commerce. While it is a great tool to enhance the security of online card transactions by providing an additional layer of authentication, it also adds to user friction, which could lead to potential card abandonment. New versions of 3DS aim to mitigate this with better user interface design for a more seamless checkout process and adaptive multi-factor authentication (MFA) with biometrics and one-time passwords (OTPs). However, challenges persist.

Merchants and payment gateways must contend with the technical implementation and maintenance complexity needed to ensure proper implementation of the 3DS protocol by updating their systems, processes, and integrating with the card networks. Merchants also face the burden of continually educating their users about 3DS security benefits while attempting to reduce the friction caused by the traditional 3DS user experience.

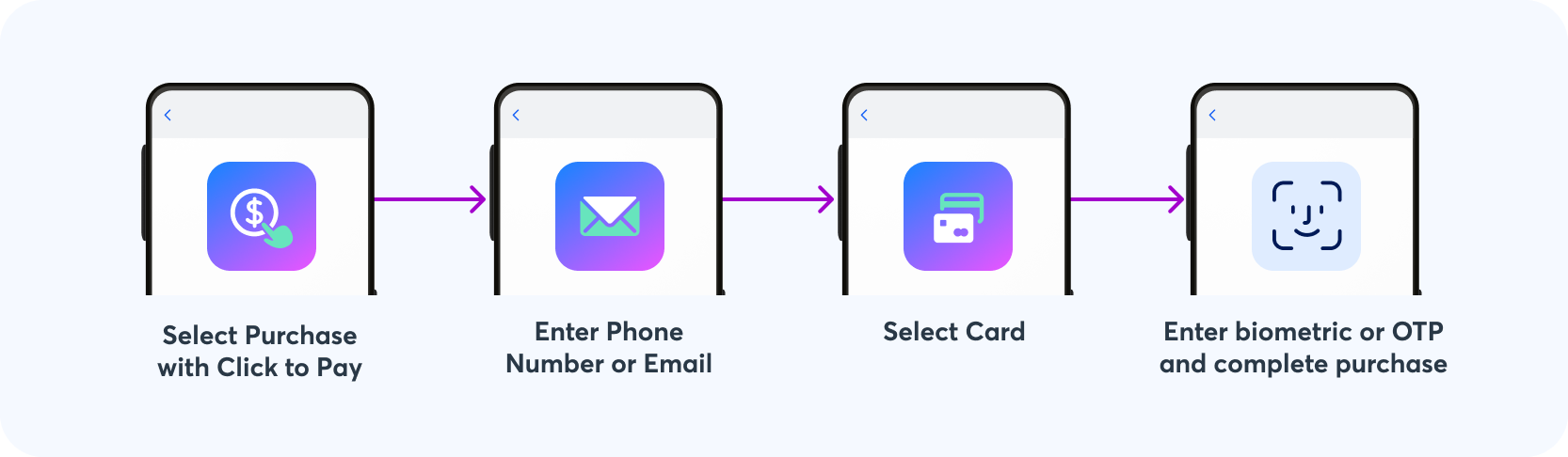

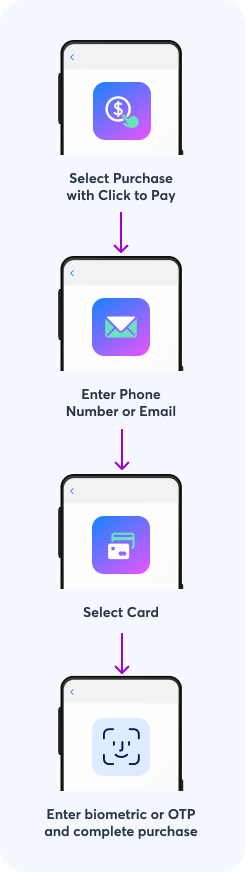

The Click to Pay User and Merchant Experience

Click To Pay is expected to enable FIDO-based biometric authentication and fits a tech-forward philosophy. It prevents the multi-hop product integration that adding traditional 3DS to your technology stack would entail, especially if you plan to offer Click to Pay anyway.

Adding Click to Pay as a payment option now will ensure you are ready for the future.

- Enhancing user checkout experience with 50% shorter checkout times to improve conversion rates and reduce checkout times by 50% to simplify and secure the payment process.

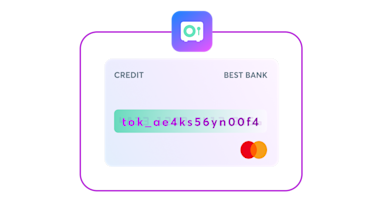

- Authenticated transactions for merchants with potential liability shift: CTP transactions will be supported by new authentication technologies like Passkeys. We also expect liability shift to issuers will come soon, making Click to Pay a key payment method starting with EU and APAC and expanding to other regions. Increased authorization rates and reduced fraud: Combining network tokens and biometrics or OTP on Click to Pay optimizes security and performance while reducing the fraud risk.

- Enabling infrastructure flexibility and compatibility across various payment processors and systems by being network token- and processor-agnostic.