Cartpanda originally had their payment data stored in a vault with their PSP before making the decision to move to a third-party vault provider for more data independence and pricing leverage. However, after servicing and support issues with their first vault provider, they needed to seek an alternate universal vault provider. Google Search and research with fellow Y Combinator alums brought them to VGS. Seeing that VGS was frequently cited as the most popular option with a reputation for being easy to implement, Cartpanda decided to reach out.

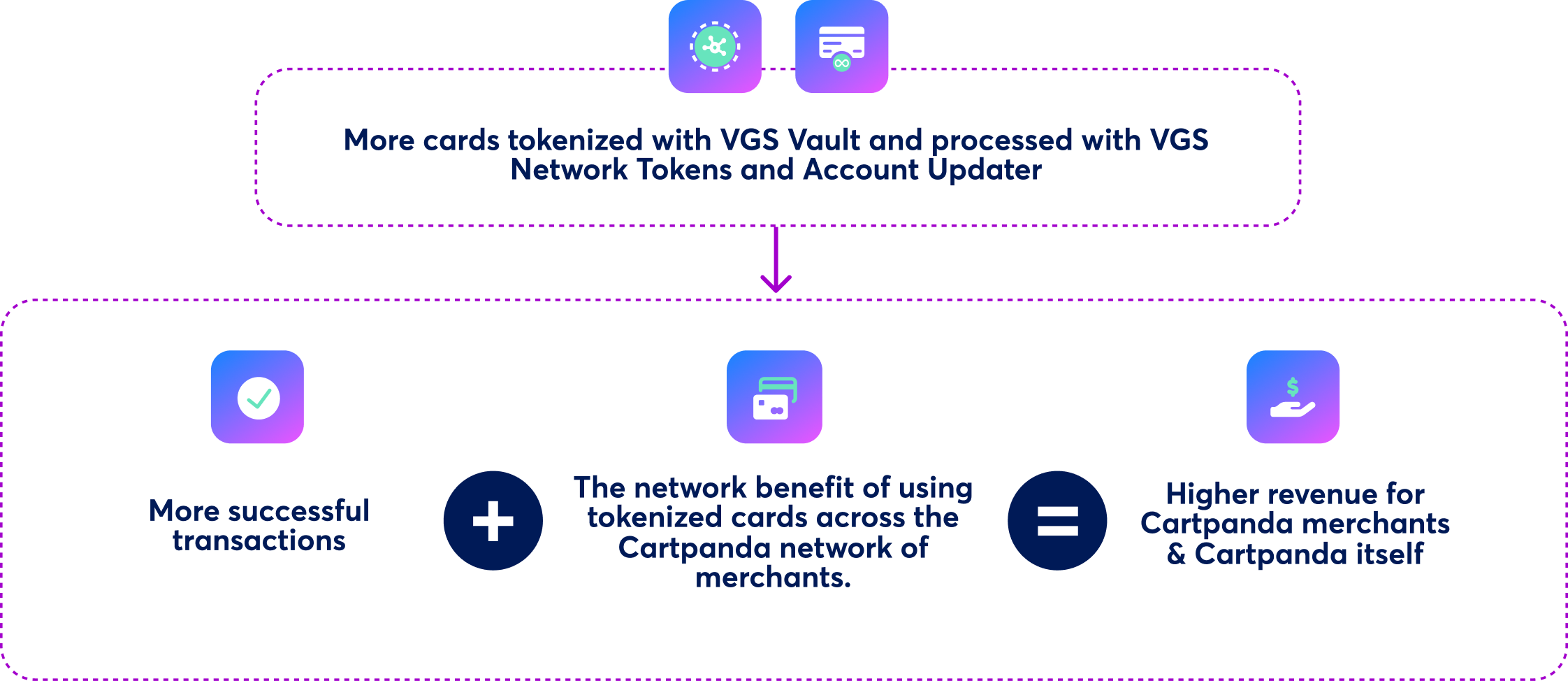

Additionally, Cartpanda had been exploring network tokens to increase payment performance. VGS is one of the only global vendors with direct network integrations, enabling VGS Network Tokens to reduce latency and improve pricing and accuracy. As a single provider for both the payments vault and network tokens, VGS became more compelling.